Our thesis on Lumerin - $LMR

the dawn of the first super commodity and the ultimate RWA that benefits from Bitcoin’s success

Lumerin is a decentralized routing systems and marketplace for hashpower, which will maturize the mining space by transforming hashpower in the first true super commodity. Content below on why it can do X100.

Super commodity

Cryptocurrency mining transforms electricity into hashpower that is necessary for securing bitcoin and other blockchain networks. Therefore, we believe hashpower will be the most important commodity in a hyperbitcoined world. We are not the only ones thinking so, Blackrock is also investing in hashpower link, where they now own a stake in the biggest mining companies in the world.

As Bitcoin becomes the backbone of the global financial system, hashpower will be as crucial as commodities like oil and steel were after the Second Industrial Revolution. First, lets refresh our commodity knowledge briefly.

Commodities are fungible economic goods, often raw materials, making them indistinguishable within their category. Unlike distinct branded products, commodities, such as ores, oil or lumber, are universally interchangeable. Central to the world economy, they underpin many production processes and have spurred the growth of global trading infrastructures.

We believe hashpower commoditization is the next logical step. Hashpower is pivotal for the security and efficiency of Bitcoin and its associated proof-of-work blockchains. As these networks evolve into global financial mainstays, the role of hashpower mirrors the importance of traditional commodities. Post the Second Industrial Revolution, oil and steel became indispensable, powering transportation and various industries. In a world increasingly reliant on crypto, hashpower is set to become the equivalent driving force. Just as industries source commodities externally, the future might see entities trading in hashpower for blockchain operations.

Contrary to most commodities though, hashpower is a commodity that can be delivered almost instantly. Where a lot of commodity trading is indirectly through middleman shipping commodities from one place to another, this is radically different with hashpower where this is not required. Even more, contrary to regular commodities, big investments are required to use commodities as input for big industrial processes and products. Someone in Kenya without mining equipment can now buy hashpower and mine with it, a true super commodity.

Lastly, most macro investors have strong believes the next decade will be one of strong commodity performance. See some links here and here. How to better benefit from that than investing in a new super commodity?!

Problems

Authenticity

Hashpower has become a new class of commodity in all but one very important aspect; it still lacks an effective and transparent means by which it can be bought and sold, while being verified as authentic and available.

Proving the authenticity and source of hashpower has been hurdles to adoption exemplified by Tesla ceasing the acceptance of Bitcoin as a means of payments until the majority is mined in a green manner link. Even Blackrock has recently recognized the need for more transparency and green bitcoin mining, which will be important in their bitcoin spot offering link. Verifying authenticity and availability are prerequisites for a well-functioning hashpower marketplace as you could otherwise not verify exactly what you bought and who you bought it from.

Centralization

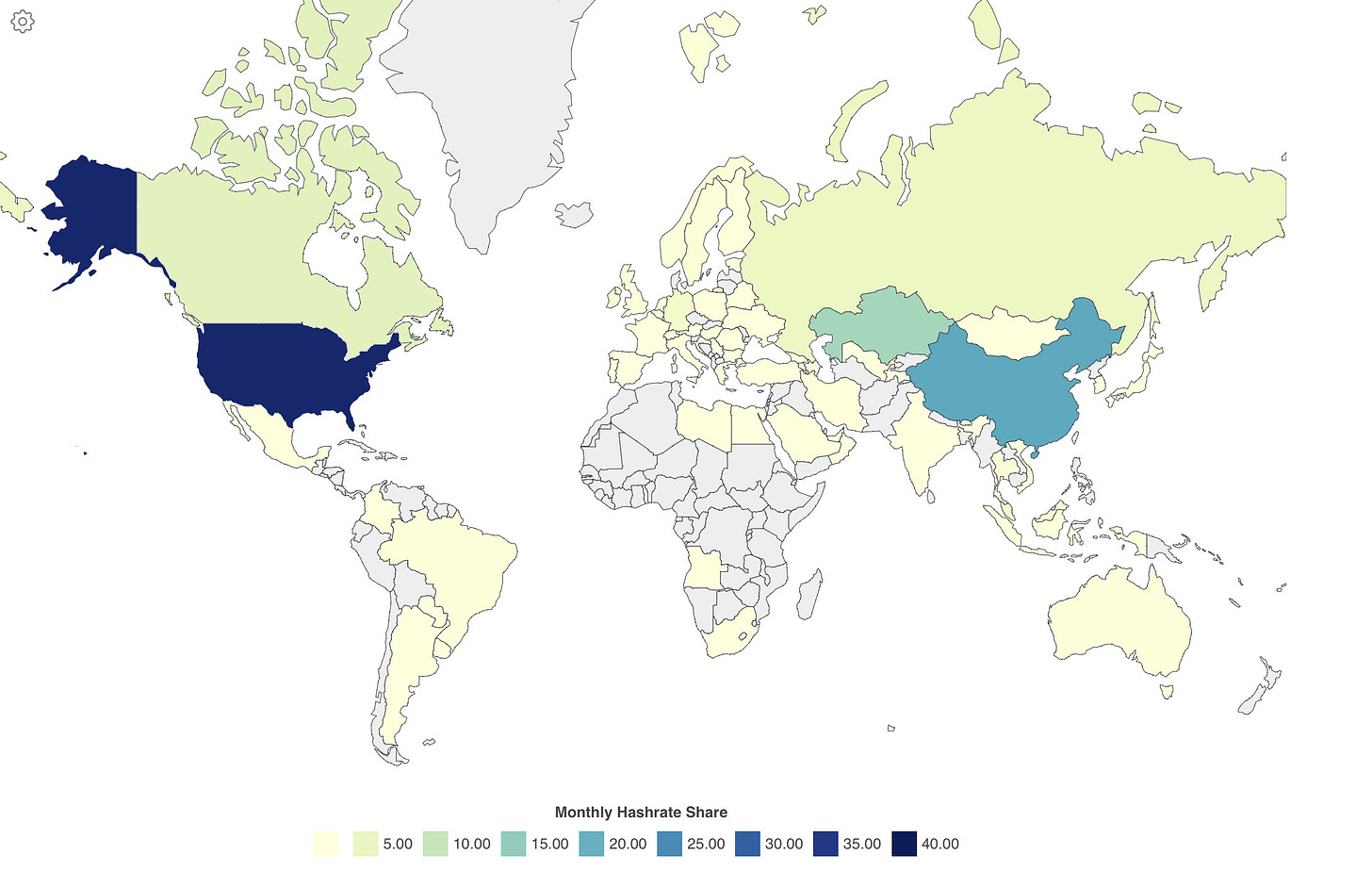

Decentralization of mining is important as in the Bitcoin network, mining has become increasingly centralized with only a handful of pools controlling most of the hashing power.

The centralization of mining is worrisome, especially given most of the mining is located in crypto unfriendly jurisdictions with China and USA counting for over 60% hashpower - see link.

Four top pools produce 90% of the Bitcoin blocks. Just like Ethereum has its problems with centralization of staked ETH, Bitcoin has a similar problem with their miners.

With Lumerin, its now basically possible to decouple the geographical centralization of hashpower from the control of the hashpower. Since with Lumerin, anyone can acquire hashpower and decide where in the world it gets directed, it can potentially decentralize the whole crypto mining industry.

Lumerin is a new platform for buying, selling, and delivering hashpower globally by proving authenticity and availability. Hereby, it creates a tradeable commodity while decentralizing the control of hashing power over time. It gives rise to a new way of mining, namely digital mining. With digital mining, one can utilize its bought hashpower and instruct mining pools anywhere in the world. So, why would this take off? As there a bunch of benefits for both sellers and buyers of hashpower!

Benefits

Sellers

On the one hand, it gives miners more buyers for their hashpower often against a premium, thereby also lowering the risk of mining hence allowing companies with a lower risk profile to enter crypto mining. Miners are strongly profit driven so these benefits make a lot of sense for literally every minder in the industry. Also, by selling hashpower upfront, miners can essentially hedge against price volatility and mining difficulty adjustments, just like what companies are doing with other commodities, see link.

Furthermore, bitcoin mining companies can capitalize on energy price differences. Certain miners benefit from lower electricity costs because of factors like geography, government incentives, repurposing dormant power sites, or bespoke deals with energy providers. These miners can leverage their cost advantage, selling hashpower contracts at standard rates and pocketing the profit margin. Lumerin can therefore even speed up the green energy movement in bitcoin mining by allowing companies to pocket in the benefits of green energy cost reductions in an easy manner, a great benefit for the new initiative in El Salvador for example link.

Lastly, miners can facilitate expansion with short-term financial influx. Price fluctuations and the unpredictable nature of Bitcoin mining can derail expansion plans. By segmenting their hashpower into brief contracts, miners can strategically funnel resources to secure the necessary capital, ensuring their growth strategies stay on track.

Buyers

On the other hand, it allows people to buy hashpower, thereby allowing for new opportunities to mine bitcoin without the need for expensive hardware. This is important as since Bitcoin’s inception, the required hashpower for miners increased by a factor of over 10 trillion. Make no mistake, this tendency is only increasing as the network adoption grows as well link.

Also, it allows for obtaining Bitcoin or other PoW cryptocurrencies anonymously. Being able to anonymously buy hashpower and mine Bitcoin goes back to the origins of early Bitcoin, when there weren’t KYC requirements for buying mining equipment. This is a big thing as the days to mine Bitcoin on the computer and buy graphic cards are over due to the mining industry becoming a play of behemoths. So, Lumerin is redemocratizing Bitcoin. Make no mistake, further decentralizing the biggest project in the blockchain space is an important task as the decentralized aspect is one of the most important selling points of Bitcoin.

Its not just retail that are now able to digitally mine by buying and redirecting haspower, miners can also be incentivized to buy additional hashpower, for example to keep up with increased difficulty. Adapting to rising difficulty levels as Bitcoin mining intensifies in competition, maintaining profitability demands heightened efficiency. Prominent miners can leverage swift, remote, and blockchain-based hashpower purchases to instantly adapt to escalating mining challenges, preserving their edge until they're able to amplify their physical setups with new equipment.

Such strategies allow them to stay ahead in the game, bypassing delays associated with machine production and delivery.

Also, procuring modern hardware, i.e. the latest ASIC mining hardware can be challenging so buying hashpower online might offer a way out in staying competitive. Just like for the sellers, volatility in electricity is also a reason to buy hashpower and secure long term contracts.

Natural evolution

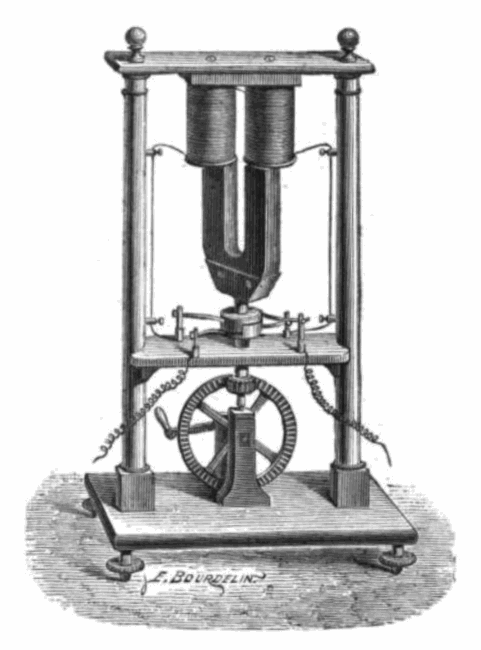

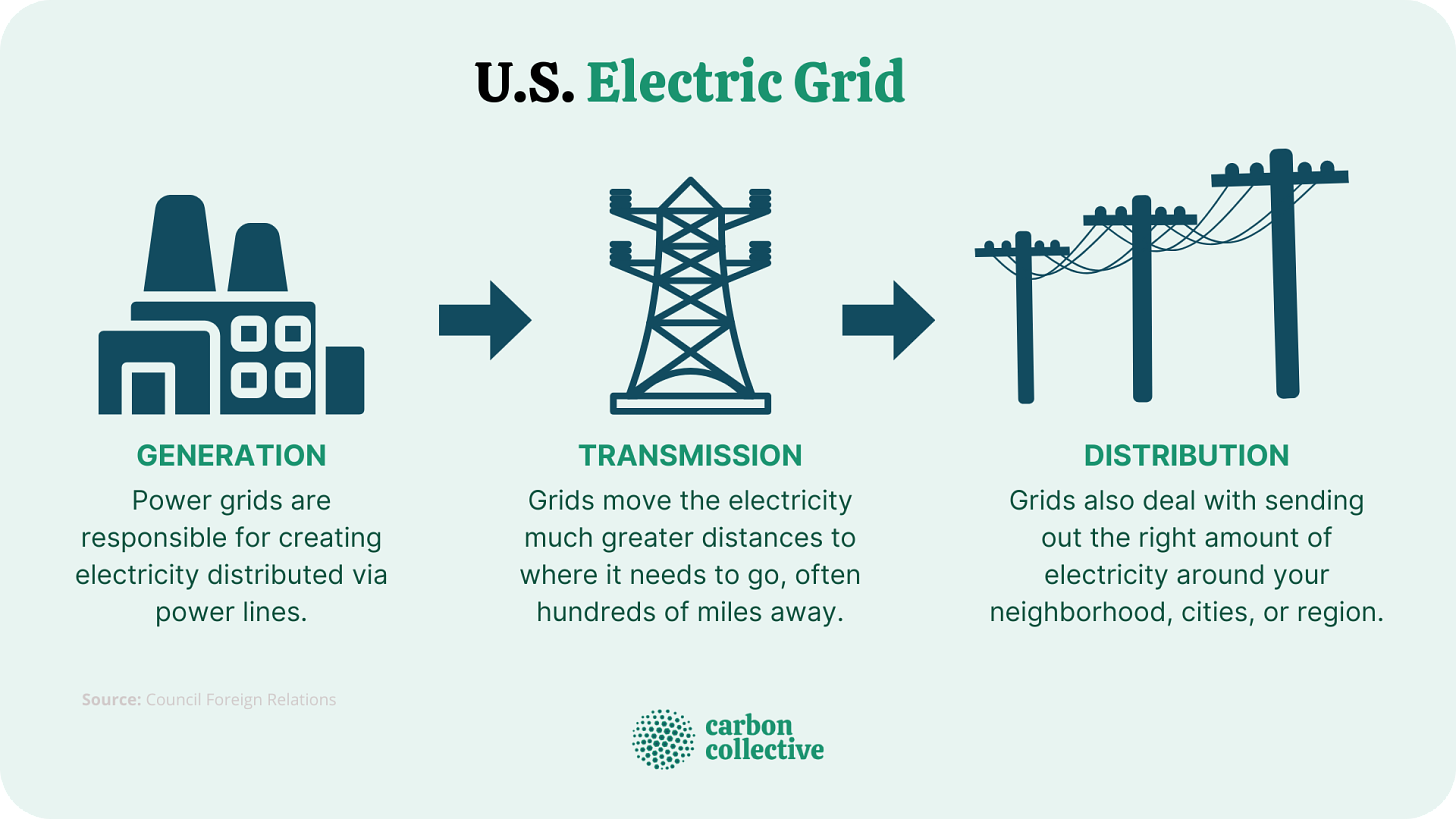

Zooming out here, we can see why the evolution of the mining industry towards the market Lumerin is enabling, is a matter of maturation that also occurred in other commodities like electricity. Where initially, electricity production was a matter of local production for own usage that powered things like a dynamo, a range of innovations matured that market in a mass market where production is generated for selling it on the open market.

Nowadays, electricity production matured towards a situation where electricity generation and usage is decoupled and the grid is the distributer in between both parties. Lumerin as innovation will also propel the mining industry towards maturity.

Imagine a power producer only getting paid if they themselves use the power that they generated; that business model would be suboptimal and risky. Because what happens if using the generated electricity is not optimal? Or, translating this to the bitcoin network, what if using the hashpower for bitcoin mining is temporary not the best option, for example due to inflating electricity costs? Or what if the mining difficulty goes up for BTC, and its temporary less attractive to mine?

Such risks affect a miner’s business obviously, but the mining industry will 100% revert away from it and be less prone to these risks. With Lumerin it is possible to partly offload that risk to someone else who will use the hashpower. Just like many industries have scaled in a similar fashion, like computing. The business model of AWS data centers is not to use all compute power itself, they simply sell off the compute power and that’s where the mining industry is heading eventually; they funnel their hashpower in a so called global hashpower grid where purchasers (governments, institutions, individuals) purchase it to process blocks and transactions. Where in the world we have local electrical grids, there is no global grid as everything needs to be physically tied together. Due to the global internet, we can create a global hashpower grid just like this happened with computing power.

So how does it work?

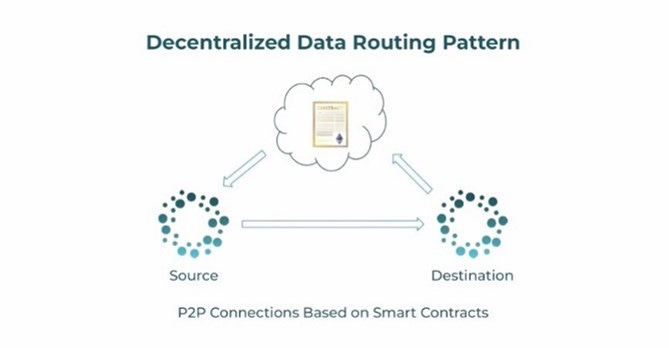

Lumerin is a decentralized routing system which contains a source node and a destination node. Both nodes broker the opening and closing of sockets through a smart contract. This allows for making these sockets automatic through a decentralized ecosystem (could also be used for video/ audio streaming, data sharing). In the case of Lumerin, it’s obviously used for the decentralized commodity hashpower, which gets brokered and routed by using smart contracts to ensure the whole process is decentralized and automatic.

On the marketplace, sellers of hashpower can list sockets from their miners for sale and anyone, anywhere can buy one of these contracts. If you buy hashpower, you can see an incoming socket to your Lumerin node, which can be forwarded to your default mining pool. For a streamlined trading process, it's imperative that hashpower contracts guarantee the safety and authenticity of transactions.

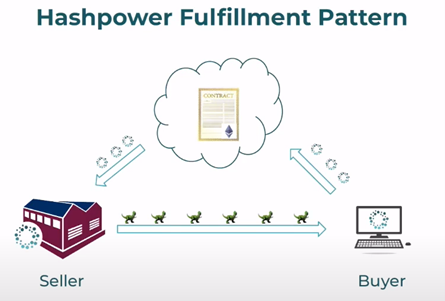

The Lumerin Hashpower Marketplace utilizes smart contracts as an intermediary, safeguarding all assets and ensuring their rightful transfer.

Buyers, when purchasing a hashpower contract, don't transfer funds directly to sellers. They secure the funds in a smart contract, which then monitors the hashpower’s rerouting to the buyer's pool. As this occurs, the contract incrementally releases funds to the seller.

Every hashpower contract showcases a miner's hashpower offer in the public market. These proposals comprise details determined by the miners, such as:

· The available hashpower speed, quantified in TH/s.

· Contract duration, denoting the hashpower supply time, in hours.

· The quoted price for the hashpower, payable in LMR tokens.

· A distinct contract address logged on the blockchain.

Team

CEO was involved in mining since late 2012 and his connections will ensure proper adoption, especially given that its provides advantages for both the buyers of hashpower as well as the miners itself. Lumerin itself is in the making since 2018 where they published the first paper and later raised about 30 million in different rounds.

The team consists of;

· Ryan Condron (co-founder and CEO) created the first customizable profit-switching mining pools, PoolWarz.

· Jeff Garzik (co-founder and advisor) created the first Bitcoin mining pool, see link, and has extensive, early expertise in Bitcoin. He is one of Bitcoin’s core developers and the main developer of SegWit2X. Evenmore, he was the third Bitcoin developer, who received the code base directly from Satoshi. So, an incredible profile that is advising and backing this innovative Bitcoin innovation. See https://academy.bit2me.com/en/who-is-jeff-garzik/. You wouldn’t think that such a profile was backing a minor innovation right? No, this is one of the biggest names in the bitcoin industry seeing the problems in the mining industry and believing Lumerin can mitigate for it.

· Jethro Grassie (Technical Advisor) developed a highly efficient mining pool used by large private mining firms.

Titan mining, one of the leading mining innovators worldwide is driving the development of Lumerin and is over 10 person big.

As you can see, some highly respected names from the Bitcoin industry are involved in Lumerin, one of which even worked with Satoshi Nakamoto before he/she disappeared link. Its not a random protocol building a solution for a vague problem, it’s the industry’s finest working on one of Bitcoin’s biggest problems.

Investors

It has Coinbase Ventures as investor and strategic partner, they also listed Lumerin as a dapp on their website link.

On 24 November 2021 Titan did a 6 million seed round to build Lumerin link after raising another undisclosed amount earlier that year. Lumerin also had IDO in which they raised 15 million link, totaling over 30 million USD in all rounds.

We weren’t able to confirm if Bitdeer invested in Lumerin, but they are a strategic partner which is big as they are one of the biggest miners in the world (being stock listed on Nasdaq, link). Actually, we expect more big miners, especially the stock listed ones to utilize Lumerin eventually. The routing system from Lumerin allows for anonymous block routing, which will allow mining pools to hide IP address and block propagation which prevents giving away all your data. The higher the market capitalization of these stock listed mining companies, the higher the urge to give away as less info as possible in this highly competitive mining industry. Remember there are Nasdaq listed mining companies and some of them will become very big so this anonymously becomes almost a requirement.

Future

Lumerin started with building their innovative project where miners can now put their hashpower for sale. Next steps will be the possibility for posting a bid (creating a bid/ask orderbook), thereby creating a true spot market as well as implications for further financialization of this new and first decentralized commodity. Think of possibilities like options, futures, and leverage trading. Lumerin is set to be the powerhouse that takes this new commodity mainstream.

It is good to note that you can mine anything with the hashpower, be it Kaspa or any PoW coin. So, Lumerin won’t necessarily be dependent on the success of Bitcoin only, if Kaspa takes off or any other PoW protocol, there is a possibility to route the hashpower to other pools.

Competition

There is no decentralized company working on this value proposition. There is a centralized for profit company with a similar value proposition, although a much smaller vision (no financial products on top of hashpower for example). The thing with a centralized company, called nicehash tackling the problem of centralization in Bitcoin, is that its not a viable solution (integrating more centralization to fix centralization). That company is equally prone to centralization risks, regulatory risks etc.

Price

Price when writing the article is around 0.005 USD, IDO price was 0.45 USD so X80 higher link. Once more financial products become available and more and more mining firms join Lumerin, this protocol can truly take off to great heights.

Miners are profit driven and according to the CEO, miners they talk with really love the idea. They have the biggest miners on earth waiting to use it is what Ryan said in a podcast recently link.

So, based on the value proposition of Lumerin’s marketplace, we believe it has the potential to be widely adopted. The current marketplace is in its early stages, but when the orderbook is released, more financial product will be enabled, and even more stock listed mining pools start using it, then sky is the limit. Bitcoin’s/ PoW’s success, will be Lumerin’s success.

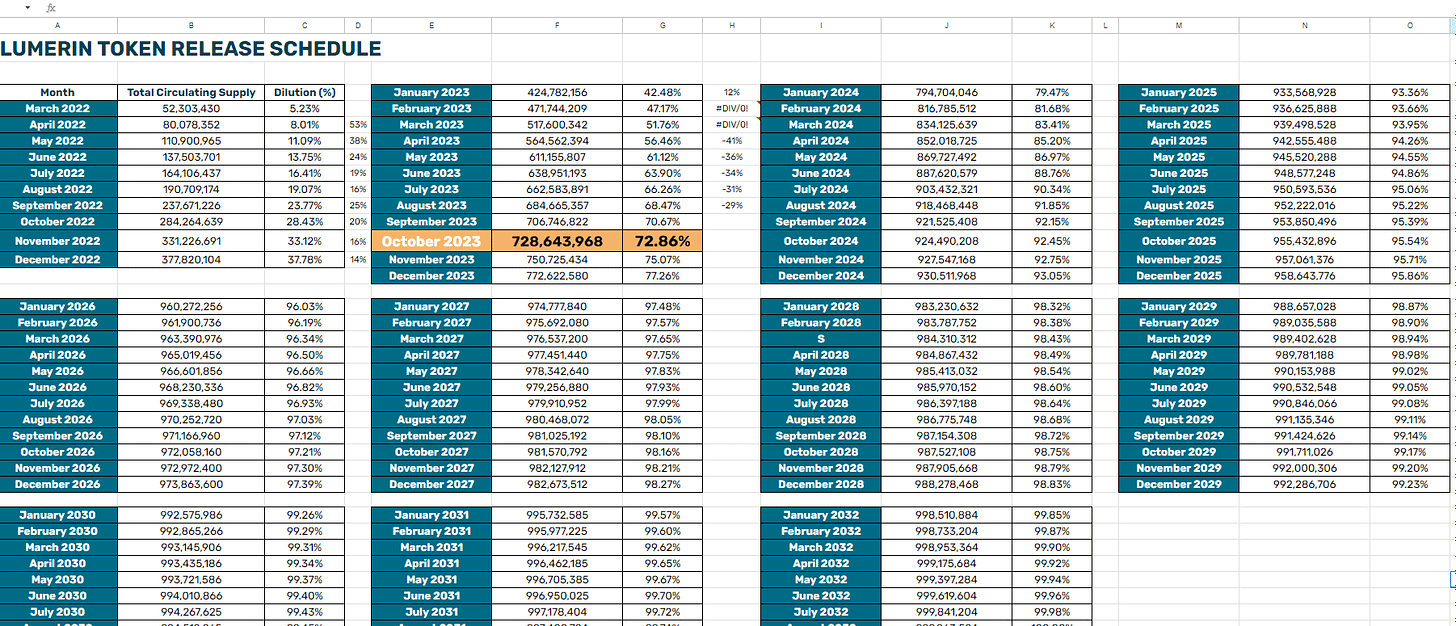

The majority of the tokens are in circulation atm (72%). FA wise, revisiting the IDO price with a small multiplier on it makes a lot of sense, equating to 1 USD. However, this can easily go towards a couple of dollars in this cycle.

What makes LMR different than BTCST (which btw was a hilarious failure)?